The 2020 year that will forever stay in the history as the year when the COVID-19 pandemic began was an extremely weird one for both consumers and businesses. But while some industries suffered (and are still suffering now, in 2021) from massive lockdowns which lead to bankruptcies, the financial industry stays afloat despite all challenges as the demand for financial services will stay strong even in the darkest periods. However, in this industry, the winners are not traditional institutions but fintech startups.

Despite the COVID-19 crisis, fintechs continue to grow all over the world. In the first half of 2020, fintech companies recorded a growth of around 11-13%. With lockdown measures, the demand for digital transactions and their volumes moved higher as well. In the countries with the strictest restrictions, the transaction volumes were 50% higher than in the countries where the lockdown measures were rather mild or were not introduced at all.

But not only coronavirus and the necessity to avoid physical contacts led to the growing interest in fintech solutions. As we’ve already told in our blog earlier, new financial technologies bring a lot of new opportunities to consumers, making transactions faster, cheaper and significantly more secure.

Sometimes fintech is viewed as the next step of the development of the traditional financial industry. But how is fintech developing itself? What are the most highly demanded features for a fintech app? And what to expect from it in 2021?

Trends in fintech app development

Our team is not a newcomer in the development of fintech solutions. Our portfolio already includes a number of successfully launched projects such as a mobile banking app of the latest generation or an MVP of a tool for investing in loans. And we always do our best to keep up to date with all the latest tendencies to make our solutions meet the strictest industry standards. So, let us share with you the most popular trends in fintech software development in 2021.

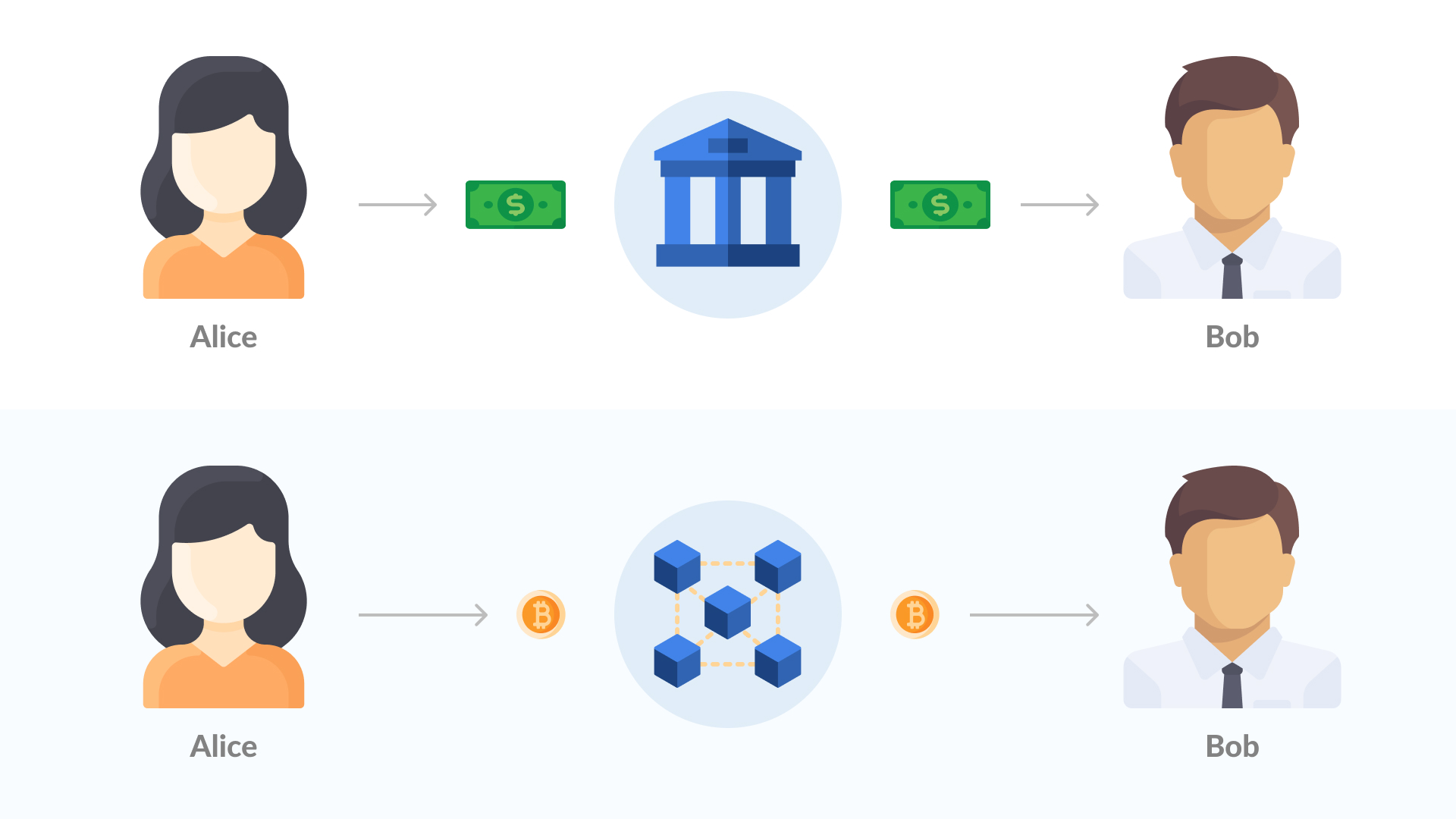

- DeFi and Blockchain. Blockchain-powered financial mechanisms and processes that are not governed by a central authority help to bring user experience to a new level. Apps of this type provide wide opportunities in p2p lending, trading and insurance without relying on external intermediaries like traditional banks.

- AI/ML. Artificial intelligence and machine learning solutions are being used in many ways. AI and ML tools help to analyze clients’ preferences in financial products, verify the authenticity of KYC documents, detect fraud, process huge volumes of data, power customer service chatbots.

- Contactless payments. Social-distancing restrictions are greatly changing the payment space. While stores and supermarkets are trying to encourage consumers to pay with cards, fintech startups are already one step forward and offer more and more options to pay with mobile apps smartphones, smartwatches and other devices without any necessity even to take a credit card out of your pocket. It’s interesting to note that 19% of US consumers conducted their first contactless digital payment in March 2020 after the first COVID-19 measures had been announced.

- Voice technologies. Voice search and voice features are gaining popularity these days. The statistics for 2020 showed that voice search is used by more than 72% of people in the US. The same tendency is observed among users of banking services. Instead of reading long FAQ sections or calling a support service, many users prefer to use voice assistants in order to get basic information on how to use different features of banking apps, make payments, check card balance, etc. Moreover, there is one more application of this technology. Some banks and services already use customers’ voices as biometric data for authorizing payments.

- RPA. Robotic process automation presupposes using software robots for automating tasks that are usually fulfilled by people. RPA helps not only to reduce costs but also to increase the overall productivity and eliminating risks of mistakes. Many fintech startups apply RPA tools for conducting user onboarding, security cheches, card processing and other tasks.

- Face recognition. Technologies that allow the identification of individuals with the help of their faces are gaining popularity these days. Such tools can identify people in video and photos as well as in real-time. It’s a convenient and fast method for verification of payments in such places as public transport, shops or cafes.

How the industry is changing

According to KMPG, 2021 will be a very resultful year for fintech.

- New markets are expected to enter the game. At the current moment, the US is a leading fintech hub, Latin America as well as the Asian countries are said to become its strong competitors.

- More fintech companies will become publicly traded. 2020 was a successful year for tech startups that went for IPOs, now it is highly likely that many other fintechs (for example, Robinhood and SoFi) will follow them.

- Cryptocurrencies will move further towards mass adoption. 10 years ago, only very limited circles of people knew about the existence of Bitcoin, now even our grannies have at least a very basic understanding of what it is. With institutional investors like Tesla and Microstrategy investing in BTC, central banks interested in launching digital currencies and payment systems offering transactions in cryptos, this type of asset has very good chances to win leading positions in the payment industry.

It is always very interesting to observe how technologies are evolving trying to satisfy social requirements in the current conditions. And the fintech space these days is experiencing a new wave of its growth amid the increased demand for remote services and digital payments.

Is 2021 a good year for launching your own fintech project? Many experts will definitely give you a positive answer to this question. Stay tuned! Quite soon we will share our ideas on how to build a fintech app that will rock the industry.