Blockchain is gradually penetrating all industries and all spheres of our life. Some fields are more prompt to some changes, while some others are not ready to accept innovations quickly. Despite the fact that the traditional insurance industry is viewed as one of the most stable markets, it welcomes new technologies and blockchain is not an exception here.

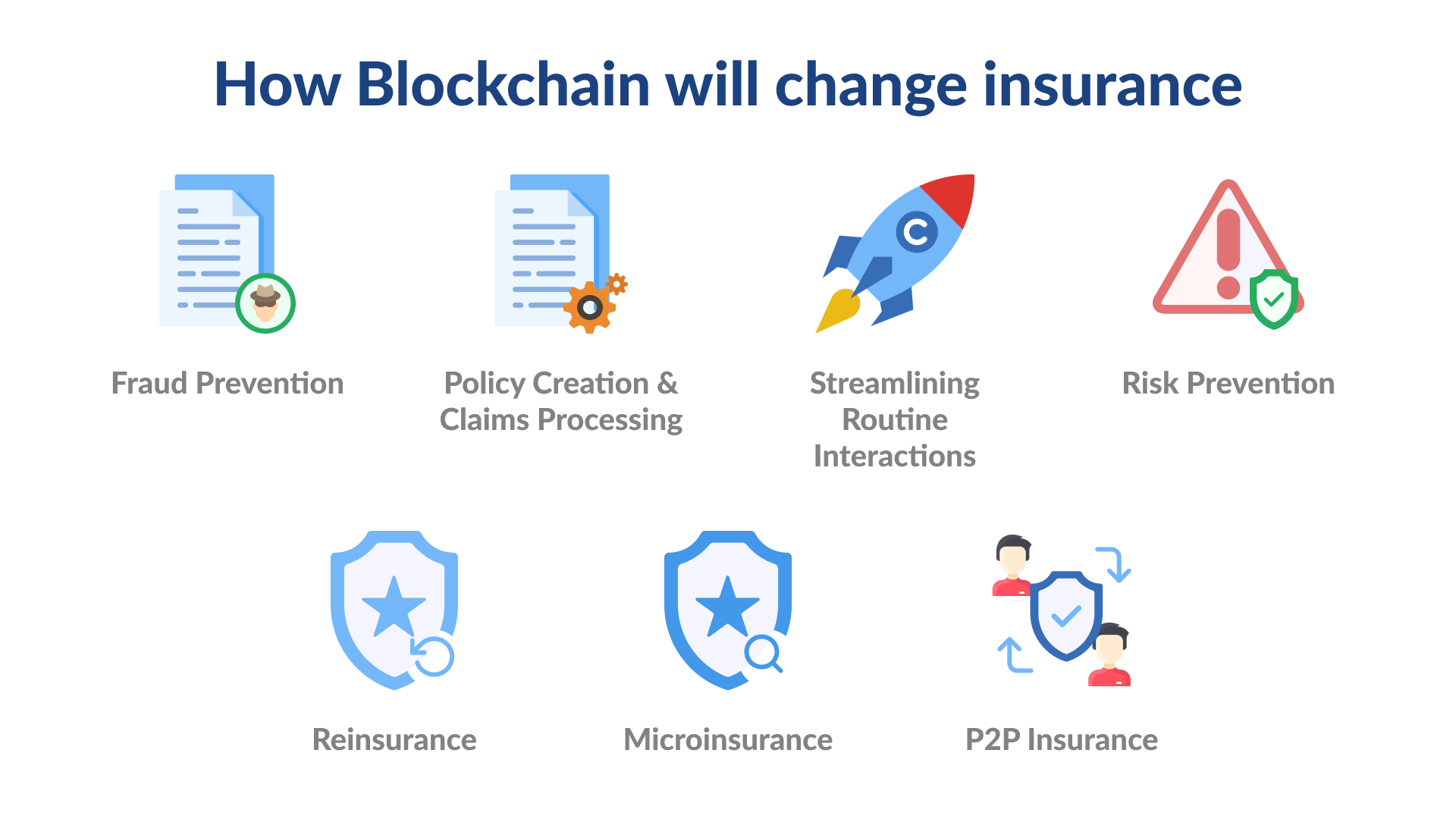

The main reason for wide blockchain adoption within the industry is quite simple: blockchain-powered solutions solve a lot of issues of the traditional insurance system. To better understand what we are talking about, let’s take a closer look at the benefits of blockchain that are the most important in this sphere.

How does blockchain influence the insurance industry?

All pros and cons that we will enumerate below are fully based on the nature of blockchain and its capacities that we have analyzed in detail in our previously published blog posts. So, if you are interested, we offer you to follow the link and to read the article.

Advantages of blockchain-powered solutions for insurance:

- Increased productivity and efficiency. Blockchain allows streamlining and facilitating many processes that are performed manually today and are very time-consuming.

- Better claims processing. With blockchain tools, data can be collected and processed in a way that significantly reduces the time needed for working with payouts or claims.

- Enhanced trust and privacy. Thanks to the cryptography used for ensuring secure and authorized transactions on the blockchain, the privacy of customers’ data is protected much better than in the traditional insurance system.

- Relying on smart contracts. Do you remember what smart contracts are and what so special about them is? These contracts are programmable and self-executing. For them to execute, it is necessary to get some predefined conditions/requirements satisfied. With such tools, companies can not only eliminate their paperwork but also cut down the costs of administration and even reduce their staff. Moreover, with self-executing contracts, many operations, such as payments, can become immediate and absolutely error-free.

But let’s be honest there is nothing perfect in the world. Blockchain is not perfect as well. That’s why if you are looking for a blockchain-based solution for your insurance business, please, consider the following limitations.

Disadvantages of blockchain for the insurance industry:

- Publicity of blockchain. One of the peculiarities of blockchains is their public availability. All the transactions are stored in the blocks and can be accessed and viewed. On one hand, it is a huge advantage. On the other – if you can access some info, fraudsters and criminals can also do that.

- Costs of solutions. The popularity of blockchain and its adoption are growing. More and more companies choose this technology for their solutions. But with the growing demand for blockchain, the cost of its implementation for companies is growing as well

It’s up to you to decide whether you are ready to put up with these limitations in order to enjoy all the benefits but some insurance companies have already successfully integrated blockchain solutions into their working process. We’ve gathered the most interesting cases for you.

Blockchain in insurance: real use cases

B3i (Blockchain Insurance Industry Initiative)

It is a Zurich-based organization and it unites insurance companies that have decided to join their forces to explore the capacities of blockchain and its benefits for the industry. In April 2021, B3i already has more than 40 organizations.

The organization views its mission in applying the Distributed Ledger Technology (DLT) and blockchain in such a way that will allow insurance companies to make their service more affordable and accessible, minimize related risks and revolutionize the way all processes are managed.

The first app of B3i on the Fluidity platform is B3i Reinsurance (B3i Re). The application is intended for insurers, reinsurers and brokers and it’s main function is to help them to create and manage digital contracts. All parties can view the contract and track its entire lifecycle. The app helps to avoid manual operations, error risks and duplication of data.

Some new features are expected to be added to the app in 2021.

Lemonade

NY-based Lemonade uses a skillful combination of DLT and AI to provide insurance to homeowners and renters. How is blockchain applied here? Via smart contracts.

Lemonade helps its clients to renovate or replace their belongings in case something like damages, theft or other bad things happen. The premiums that are paid to the company are placed in a pool. Around 20% out of this pool are taken by Lemonade for covering reinsurance and operating costs.

If somebody makes a claim, the money is taken from this pool. When a claim is made, smart contracts will verify the loss and process the payments. It’s also interesting to know that if by the end of the year, some premiums are left in the pool, the money is donated for charity.

Teambrella

It is a blockchain-powered peer-to-peer application. The app utilizes blockchain and smart contracts to conduct insurance payments. Users are united in groups and if something that requires insurance payments happens, a person shares a problem with his or her groupmates. Via voting and discussions, the group decides whether the money should be allocated for this or that claim.

Do you want to boost your business with a solution of this kind? Or maybe you already have a completely different idea? No issues! We are here to help you! Just contact us and we will discuss what we can do for you.