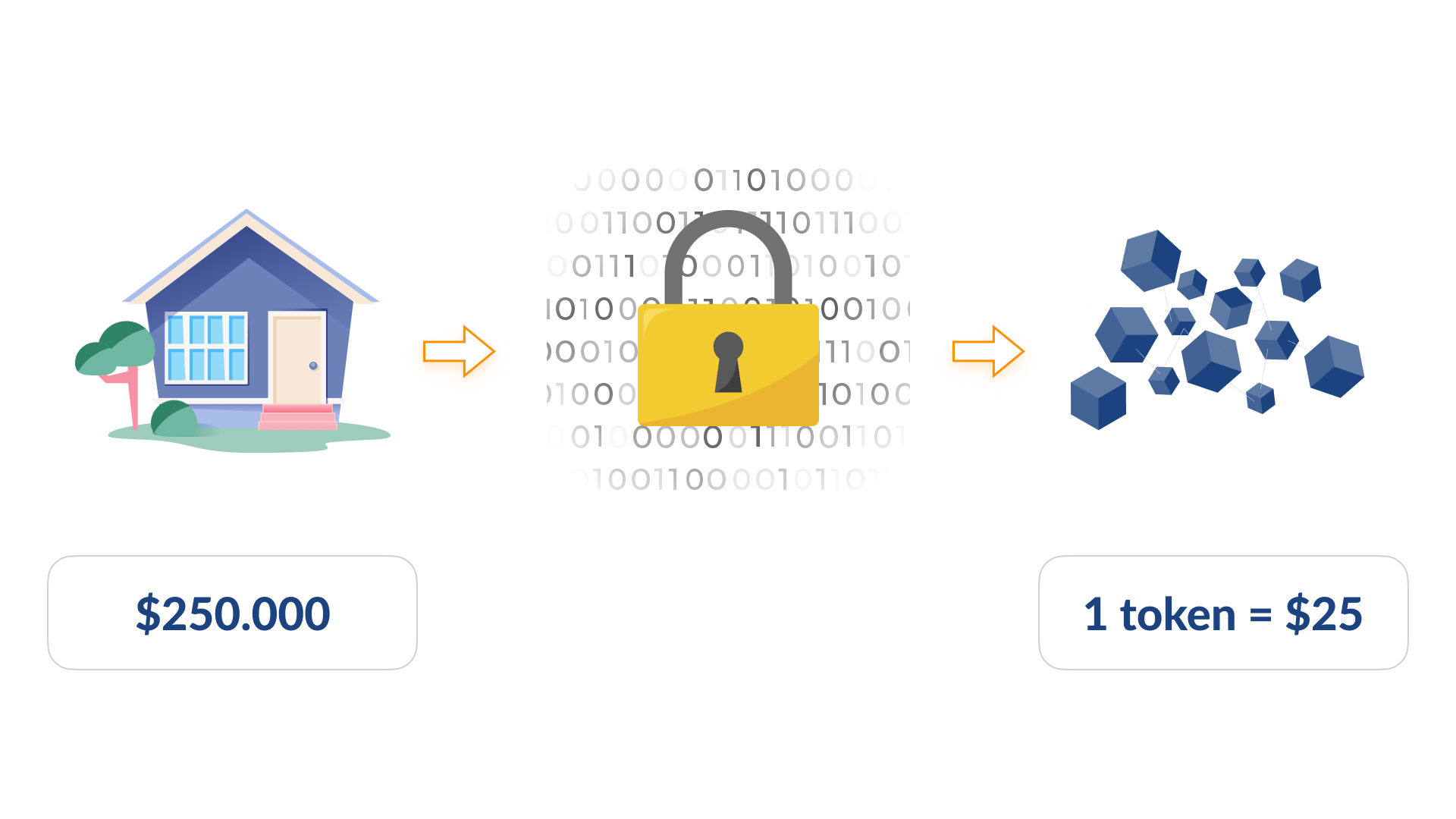

Actually, if somebody told you that you could tokenize practically everything, it would be very close to the truth. You can choose practically any real-world asset and transform it into a digital form to make it tradeable on the blockchain.

What can you tokenize?

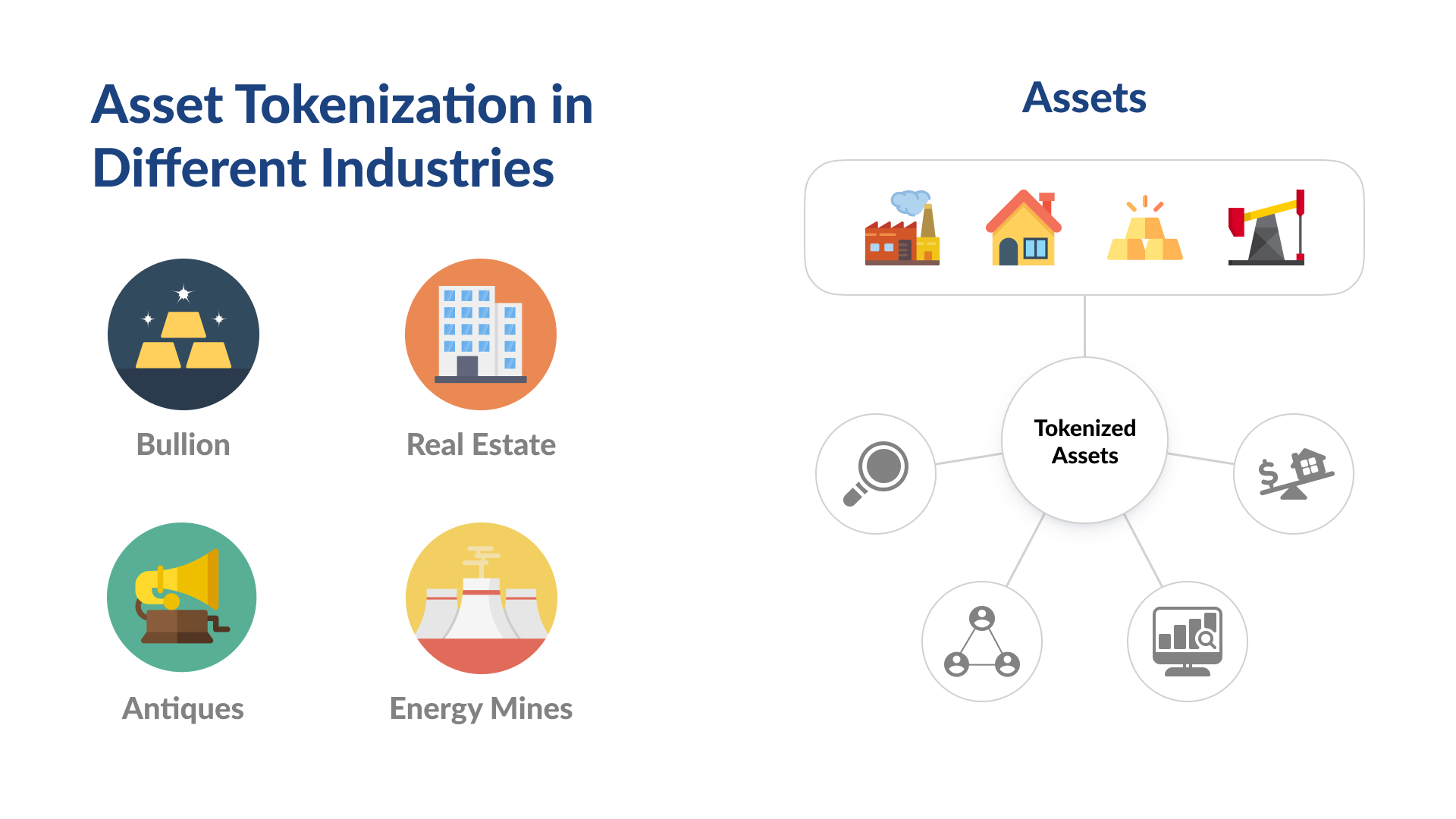

Today’s digital market has already seen tokenized commodities, bonds, real estate and even sports teams, artworks and energy. Yes, as for energy, we have had such a case in our practice when the company decided to launch tokens. One token was tied to 1 kWh. This move was aimed at increasing client loyalty as with such tokens they can get a discount on mining services. You can read more details of this project following the link.

Let’s take a look at some of the most popular assets that get tokenized.

- Commodities. Transforming physical assets into digital tokens that can be easily traded helps to improve their liquidity and to overcome all the barriers that investors may have face when they want to trade traditional commodities.

- Real estate. Tokenization of fractional ownership allows expanding investment markets for the industry and attracting wider circles of investors.

- Private equity shares. If a company takes a decision to tokenize its shares, it gets a row of important benefits. First of all, shareholders can get the information from the company on an immutable shared ledger, while in the traditional form of business organization, all info about the company is recorded on spreadsheets or paper documents. And of course, such a form of info flows is accompanied by risks of errors. With the ledger technology, the risks of errors in data are minimized. And the second important benefit for shareholders is that their ownership rights are fully transparent.

- Different physical goods. The range of physical items that can be tokenized today is really wide. The reason for the popularity of this approach to the digitalization of real-world assets is the transparency of all the transactions related to them which is ensured by blockchain. Moreover, with tokenized assets, much more investors get access to the market even if they are not ready for venturing into high-value investments.

If we speak about tokenization, it’s crucial to mention such a phenomenon in the crypto world as NFTs (non-fungible tokens). In this case, each token is unique. And unlike any common token, it can’t be traded with other tokens. And that’s its second peculiarity. Though they can be used as a digital representation of practically everything you want, quite often they are used for selling digital art. You can read more about the NFT craze in our blog as well.

Benefits of tokenization for businesses

Today we can observe the skyrocketing popularity of tokenization. And this trend can be explained not only by the increasing adoption of cryptocurrencies and blockchain-powered solutions but also by the benefits that this phenomenon brings.

Among the benefits of real-world asset tokenization, we would like to highlight the following ones:

- Transparency. No fraud is allowed thanks to the keeping of all the records on the blockchain. With public access to all the data stored, all the ownership records can be viewed by everyone.

- Accessibility of assets. No matter where you are, you just need to have an internet connection to access tokenized assets at any moment you wish.

- Cost-efficiency.As you may already know, transactions on blockchain do not presuppose any participation of intermediaries like banks or payment services providers. Thanks to this fact, the cost of transactions is significantly reduced.

- Immutability. If you are an owner of tokens, you can’t be deprived of your ownership rights unless you want to sell them to somebody else. All ownership records remain immutable.

- Easiness of investments. With digital assets, the requirements of minimum investments are removed. It makes it possible to become investors for a wide range of market participants.

Being a bridge between digital investors and real-world businesses, asset tokenization is here to revolutionize the way the financial industry is organized today. Thanks to the capacities of distributed ledger technologies and blockchain, the idea of tokenization has attracted the attention of numerous companies of all types and sizes.

Are you interested in the tokenization of your company’s shares or any physical assets? We are here to help you and to provide you with our professional insights. Let’s ensure seamless and efficient digitalization of your business together! Don’t hesitate to contact us.